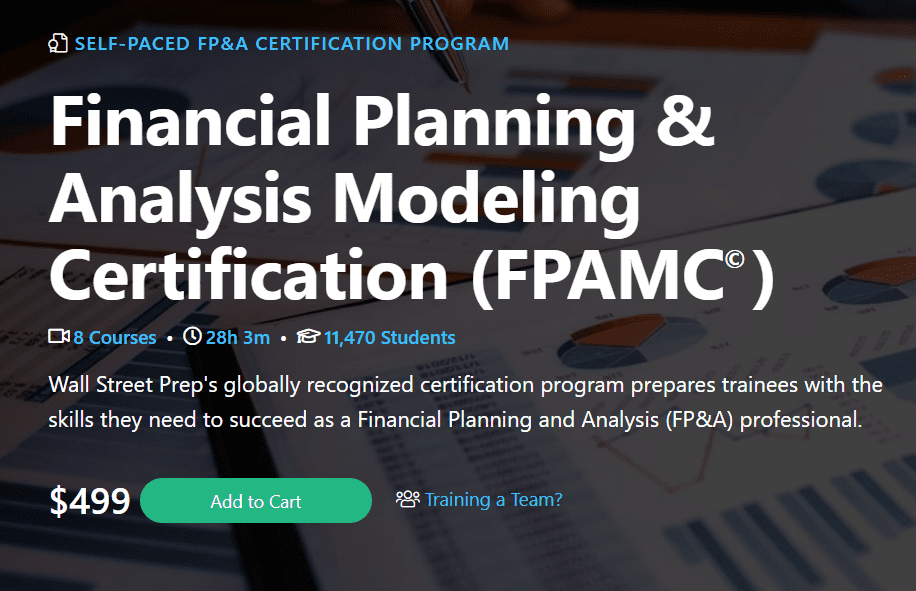

Financial Planning & Analysis Modeling

Original price was: $499.00.$124.00Current price is: $124.00.

Product Delivery – You will receive Content Access Via Email.

Email – Kickmarketers@gmail.com

Description

Financial Planning & Analysis Modeling

Financial Planning & Analysis Modeling

Description:

-

Earn a verified certification

Shareable on LinkedIn and in resumes

-

Earn 33 CPE Credits

The FPAMC© is a NASBA-registered continuing professional development program

-

Globally Recognized

Used by by the world’s leading companies to train their FP&A Analysts and Managers

- The FP&A Profession

- Budgeting

- Forecasting

- Operating Model

- Data Visualization

- Data Presentation

- Corporate Finance

- Market Research

- Project Management

The First Rigorous Certification for the FP&A Profession

The FPAMC© is a career-focused program designed for:

- FP&A Analysts and Managers

- Financial Reporting Groups

- Controllers and CFOs

- Accounting Professionals

- Bridging the gap between theory and practice in FP&A The FPAMC© is focused on equipping learners with actual, practical competencies and best practices in FP&A. Developed by FP&A professionals and used by finance teams from the world’s leading companies, you’ll learn how to forecast detailed operating models step-by-step, create long-range plans with built-in scenarios, and craft both short- and long-term projection models and construct data visualizations that bring numbers to life.

- Job-Focused Certification Program Solid financial modeling, data analysis and forecasting know-how is just one part of the FP&A professional’s toolbox. This challenging position also requires interpreting, visualizing and presenting data – often stepping back from modeling and data analysis to work cross-functionally to arrive at answers. The FPAMC© fills these knowledge gaps and establishes best practices for FP&A professionals.

The FPAMC© is the same program used to train FP&A hires at some of the world’s leading Fortune 500 firms.

Wall Street Prep trains FP&A professionals and others across the CFO suite at leading global corporations.

““We use WSP’s FP&A program because it’s the only cohesive training we’ve seen that connects the dots of accounting, technical finance and corporate strategy and gets to the heart of the FP&A function.”

— VP of Finance, Fortune 500 Cloud Computing Enterprise Software Firm

”

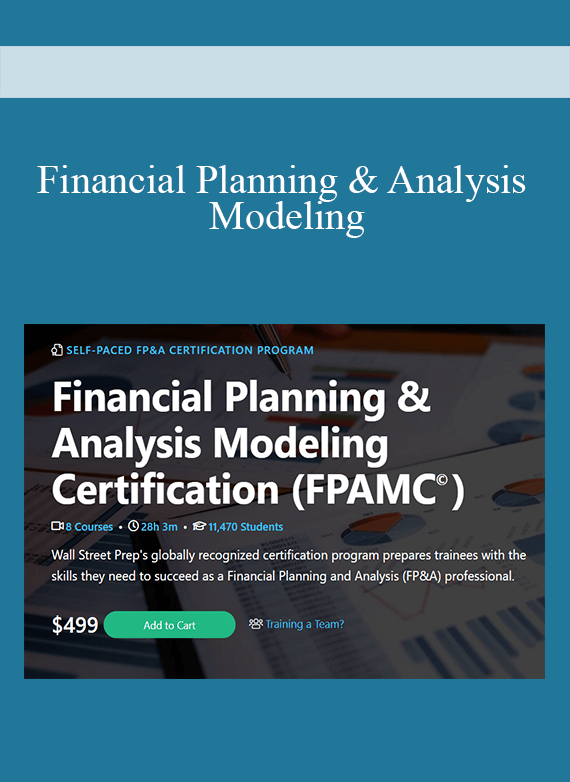

Your Path to the FPAMC©

This FP&A certification course is career-focused. We begin with an overview of the FP&A career pathway, what the role entails and the systems and concepts you need to know. We move on to build an operating and forecasting model and create a long-range planning model to discuss the use of scenarios and sensitivities in forecasting. Finally, we learn how to use short-term pacing models, dynamic dashboards and data visualization to inform and influence business partners. As a bonus, we explore how to utilize advanced corporate finance principles to guide firm strategy.

Recommended Path

- 1 An Introduction to FP&A Week 1

- 2 Building the Operating Model – The Income Statement Week 2

- 3 Building the Operating Model – The Balance Sheet Week 3

- 4 Building the Operating Model – The Cash Flow Statement Week 3

- 5 Pulling Together the Operating Model Week 4

- 6 Project Management, Long-Range Planning & Analysis Week 5

- 7 Presentation Best Practices & Building Dashboards Week 6

- 8 Appendix: Corporate Finance Principles Week 6

Complete in 30 Hours

The FPAMC is a job-focused program that drills down on what FP&A professionals need to know while cutting out the rest. Average completion time (coursework + exam) is 30 hours.

- Forecasting and Budgeting Covered

- Variance Analysis Covered

- Financial and Strategic Planning Covered

- Pacing, Projections, and Dashboards Covered

- Building Presentations Covered

The FPAMC© Includes the Following 8 Modules

An Introduction to FP&A

Building the Operating Model – The Income Statement

Building the Operating Model – The Balance Sheet

Building the Operating Model – The Cash Flow Statement

Pulling Together the Operating Model

Project Management, Long-Range Planning & Analysis

Presentation Best Practices & Building Dashboards

Appendix: Corporate Finance Principles

Course Samples

- Course Intro

- Salary Expense Budget Vs Actual Example

- Pivot Charts

- Detailed Revenue Forecast: Transactions

- Accruals and Reserves

- Operating Leverage

- Dashboard Example Overview

- Budget vs. Actual (Excel Sample)

- Long-Range Plan (Excel Sample)

Proof Content

Sale Page: https://www.wallstreetprep.com/self-study-programs/financial-planning-and-analysis-modeling-certification/

Archive: https://archive.ph/ulWNl

Delivery Method

– After your purchase, you’ll see a View your orders link which goes to the Downloads page. Here, you can download all the files associated with your order.

– Downloads are available once your payment is confirmed, we’ll also send you a download notification email separate from any transaction notification emails you receive from imcourse.net.

– Since it is a digital copy, our suggestion is to download and save it to your hard drive. In case the link is broken for any reason, please contact us and we will resend the new download link.

– If you cannot find the download link, please don’t worry about that. We will update and notify you as soon as possible at 8:00 AM – 8:00 PM (UTC+8).

Thank You For Shopping With Us!

![[Download Now] Rob Pene - Get More Clients Video Analysis for Leads From Cold Email](https://kickmarketers.com/wp-content/uploads/2024/01/download-now-rob-pene-get-more-clients-video-analysis-for-leads-from-cold-250x297.png)

Michael Murphy (verified owner) –

The instructor’s passion for the subject is contagious.

Sarah Alexander (verified owner) –

I learned a lot from this course. Highly recommend!

Ashley Parker (verified owner) –

I appreciated the hands-on approach to learning.

Ryan Griffin (verified owner) –

I learned so much from this course. Highly recommend!

Zohar (verified owner) –

The lessons were clear and well-organized.

Matthew Thomas (verified owner) –

This course is a great resource for anyone looking to learn this topic.