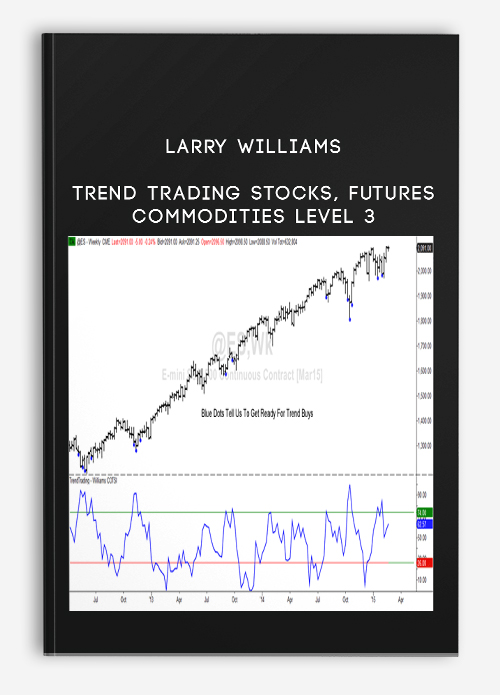

Larry williams – Trend Trading Stocks, Futures, & Commodities Level 3

$504.00

Product Delivery – You will receive Content Access Via Email.

Email – Kickmarketers@gmail.com

Description

Larry williams – Trend Trading Stocks, Futures, & Commodities Level 3

Archive : Larry williams – Trend Trading Stocks, Futures, & Commodities Level 3

LARRY WILLIAMS UNIVERSITY LEVEL THREE ONLINE TRADING COURSE

HOW TO TRADE FUTURES 3

TREND TRADING STOCKS, FUTURES, & COMMODITIES

CHECK OUT THE CHARTS

THEN CHECK OUT THIS ONLINE TRADING COURSE!

The blue “showme” spheres demonstrate my Williams Trend Trading Patterns

Trend Trading Buys

Trend Trading Sells

In Trend Trading Stocks, Futures & Commodities, you’ll learn how to stop being burned by premature Commercial selling and buying – once you learn how to use my Williams Trend Trading Patterns in conjunction with my new amazing indicator…

Williams COTSI: Stock Traders – you have dreamed of this! I know, because I did too! Both of these incredible tools work on stocks as well as futures

Williams TTP with Williams COTSI

Williams WillTrend: An amazing trend following tool unlike anything you will find!

WillTrend Indicator Example on Gold

My COTSI works for Stocks – look at Altria. That is just a sample of what this course has to offer… Now, let’s get to the heart of it all

WillTrend Indicator Example on Altria

TRULY AMAZING BUT PLEASE READ OUR DISCLAIMER

TREND TRADING STOCKS, FUTURES, & COMMODITIES IS THE THIRD ONLINE TRADING COURSE IN OUR LWU SERIES… ANOTHER COMPLETE SEMINAR THAT COMES TO YOU OVER THE INTERNET, INCLUDING ACCESS TO LARRY’S TREND TRADING WEBINAR ARCHIVE – 2013 THRU 2015 MONTHLY WEBINAR RECORDINGS LARRY COMPLETED WITH STUDENTS. YOU CAN WATCH LARRY USE THE COURSE TOOLS IN TODAY’S MARKETS.

“Trend Trading Stocks, Futures, & Commodities” is a video on-demand course. The online trading course is at your beck and call. You can watch the videos when you want, as often as you want, and from where ever you want. All you will need is a decent high speed connection.

This style of self-paced learning allows you to absorb the stocks, futures and commodities course material at a level that suits you. Plus there are no travel expenses or airport hassles.

The course has been broken into a series of videos complimented with a complete course manual. The trading course videos are packed with trading tools and chart examples. You will need more time than a weekend to comprehend the course material and that’s just what you get – more than enough time to watch and learn.

With your purchase of the “Trend Trading Stocks, Futures, & Commodities”, you get SIX MONTHS of access to all the online trading course videos. You can watch the videos as often as you want or need throughout the SIX MONTH period. You will also be able to download the stock, futures and commodities course manual and keep it forever.

PLEASE NOTE: The Videos are Streamed.

They are NOT downloaded to your computer. For this type of delivery you MUST have a high speed internet connection. If your internet connection speed is too slow, the video will constantly stop and start. It will be a very frustrating experience. So do NOT buy this course if you do not have a high speed connection. Neither of us want this to be a bad experience! Please watch the following sample video before you decide to buy:

Watch a test video to verify your connection speed is ok – Click HERE

The core focus of this online trading course is my Williams Trend Trading Pattern, a trading pattern as close to perfect as I have ever found in the marketplace, but there is much much more to this course. We will get to that shortly, but let’s start with the heart of it all.

Let me start by being very blunt. Some disagree, but I believe there are patterns in the marketplace that do predict future market performance.

Trend Trading Patterns are extremely difficult to find, but once you identify them, they may be quite profitable.

That’s what this online trading course is all about… my Williams Trend Trading Pattern which is a specific combination of price activity and insider buying. This pattern has been kept between myself and just a small number of students for the last several years… now it can be yours.

A Word of Caution: if you’re a day trader or want trades that last just a couple of days, this online futures and stock trading course is NOT for you. This course, the idea of Williams Trend Trading Patterns, is for the trader/investor looking for positions that should last for weeks, not days or a few hours. THESE ARE TREND TRADES. If you are a short-term trader; close your browser right now, really.

For those of you that are still with me… I will teach you what I think is the best pattern that I have found in my 50 years of trading and researching markets for trend trades. I simply haven’t ever seen anything better.

This entire idea goes back to 1973 when my mentor Bill Meehan, casually mentioned a relationship between price and the Commercials activity in the marketplace. As you know, Commercials are the users and producers of commodities, they are truly the insiders.

But there are a couple problems… frequently the Commercials are way too early, and there is no Commercial reporting requirement for stocks.

Well, I had to solve this problem. This is something I wrestled with for more than 30 years. Now I believe I know what the best Commercial buy and sell signals look like. I can show them to you, so you will know, in a heartbeat.

But that simply wasn’t enough. I had to figure out how to use this information for the stock market. My solution? I created a synthetic COTSI Index that mirrors the actual Commercial trading… In fact, the few people who I have shown this to think my Williams COTSI is better than the actual COT index! I can say that because I created the original COT index in the late 70s. I have been using both for more than a decade.

You can judge for yourself in the next few minutes…

Williams COTSI Compared to William COT Commercial Index

Take a gander at the above chart of Bonds. The Williams COTSI is in the bottom pane in blue while the actual Williams COT Commercial Index is right above it in red. My Williams COTSI does not use any information from the Commitment of Traders Report. It uses a unique flow I have uncovered in the marketplace. Please, notice how closely the index parallels the actual COT Report data. You will see this in commodity after commodity after commodity… in other words, I think I have figured out the way the Commercials buy.

Hold on, you will see more examples right here.

And better yet… this index can be used for any stock, traded any place in the world, on any stock exchange. Instantly, you have the ability to see if my Williams COTSI suggests the Commercials would have been buying or selling your stocks.

But that’s not nearly enough… at times, the Commercials are flat out wrong in the marketplace… usually they are correct, but not always.

I will be the first to tell you that my Williams Trend Trading Patterns are the best thing I’ve ever seen for trend trading. And the first to tell you the markets are an imperfect world full of random surprises. So some obviously will not work.

If you can’t deal with that fact – that nothing is 100% correct – then you should not be trading. Again consider closing your browser if you think there is no risk to this. There is tremendous risk to trading futures and commodities, as well as stocks.

With that said, plenty of these signals have been successful. I think they give us the greatest bang for our buck. In other words, these trend trades are designed to capture major moves in the marketplace… not little wiggle waggle trades. Yes, I’m talking about moves where you can potentially make large sums in one trade on one contract.

HOW IS IT DONE?

The techniques I teach in this course show exactly what the Williams Trend Trading Pattern is. It is not just about when the insiders are buying… no… it is about how they buy… that is the big breakthrough.

If you’ve watched the markets at all, you know that sometimes the Commercials are way too early in their buying or selling. In fact, everybody who’s ever written about this data has made that point.

It really gets down to this… I’m really letting the secret out of the bag here…

The Large Traders are the driving momentum force of the market. When the Large Traders’ Net Long Position is increasing, the trend of the market to the upside is intact. When it is declining, the trend of the market is to the downside and you don’t want to be buying. Even if the Commercials are in a bullish mode!

Check out a sample video giving you a little flavor of what is in this course – you’ll want to do this also to verify your connection speed will be fast enough to watch these videos. The videos are streamed, not downloaded.

It’s probably a lot easier for you to see this than it is for me to explain it in a hundred words or less. You will see that the Large Traders are the driving force of the market. It is our task to get in phase with them and the Commercials. We have these two things going for us, plus the price structure (pattern) to top it all off. This gives us the best of both worlds to point out the Williams Trend Trading Pattern opportunity.

HERE’S THE REALLY FASCINATING THING…

After I had created the synthetic index for the COT, I toyed around with the idea of creating a synthetic index for the Large Traders from the COT report. I call this Williams LTSI (Large Trader Synthetic Index). I’m very pleased to announce I was able to do that. Just take a look at the next chart.

Williams LTSI on Weekly Basis

It doesn’t matter what commodity we look at, in this case it is Bonds. You will see the same thing, time and time again, that the Williams synthetic index for Large Traders essentially emulates or mirrors the actual Commitment of Traders Report for Large Traders Index. How cool!

Stay with me for a moment on, this gets very exciting…

As you may know, the Commitment of Trader Report only comes out on a weekly basis and even then, it is delayed a few days. So we don’t really have right up to the minute information on what these guys are doing.

But like I said earlier, I have developed a way to construct a synthetic index without the use of any of the COT report, which means…

WE NOW HAVE THE COMMERCIAL AND LARGE TRADER SYNTHETIC INDEX INFORMATION

AVAILABLE TO US ON A DAILY BASIS!

Yes, that’s one of the big things you’ll learn in my Trend Trading Stocks, Futures, & Commodities Course. You’ll learn how to know exactly what these guys are most likely doing on a daily basis. How exciting is that?

Williams COT Large Trader Index vs Williams LTSI Daily Basis

As you can see from the above daily chart, the Williams Large Trader Synthetic Index is essentially the trend of the marketplace. And again you see it closely follows the actual weekly reporting period of the Large Traders COT Index (the blue line). This just proves my point so well… Large Traders cause the momentum of the market, and now we can know on a daily basis what they are most likely doing.

If that is all you were to learn in this online trading course, it would be worth two or three times the nominal fee.

BUT YOU’RE GOING TO LEARN SO MUCH MORE THAN THAT…

You’ll have more than the Williams COT Synthetic Index and the Williams Large Trader Synthetic Index for Stocks and Commodities. I will also show you how these indexes are different for each commodity.

Just think about this for a moment;

the Commercial that raises hogs is a different operator or Commercial that mines gold. That is a staggering thought…

This means we need to treat the Commercials Trading Activity different for each producer. I will show you exactly how to adjust for these differences.

No one else has figured this out… no one else does this… no one else knows this secret. But, now you can! It is without a doubt, a revolutionary approach to using the COT indicators.

Like I said, there’s so much more to this online trading course; we will also revisit my Valuation Index, take a look at Seasonal Trading, and fully reveal my combination of Price, Open Interest and Volume (POIV) all placed into one indicator. (Another first, a tool you have never seen before)… this is not the one shown in my books. I think this is better. ?

Yes, this is a fascinating way of measuring the accumulation and distribution each day in the marketplace. I’ve been able to combine all three elements; Price, Open Interest and Volume into one measure of buying and selling. You can use it just like On Balance Volume… only it is far superior and works in the new electronic markets where OBV does not. Here is an example:

POIV Example on Daily E-Minis

I am convinced that this indicator will add a great deal of meaning to your trades in helping you find markets that are setup for substantial and immediate moves… in that it will help in pin pointing entries.

I also think you will agree with me — once you see it — POIV will make your trading life much easier than it is now.

POIV Example on Daily Gold

BUT STILL, YOU GET MORE…

Let’s face it, if you don’t know when to get into a market (all you know is that it setup). You will still have problems and will still be frustrated.

It is for that specific reason that I will teach you new entry techniques.

You will learn my WillTrend Indicator, a great long term 100% mechanical entry rule. Also, for the first time ever, I have put together a comprehensive explanation of my Universal Entry Technique… the technique I’ve been using for some 30 years. This is my extension of the work done by Henry Wheeler Chase. You will learn everything I know about short-term, intermediate-term and long-term market highs and lows.

I call this Market Structure. To me it is the most important technical knowledge in the marketplace. You’ll understand the real building blocks of the markets and will be able to use it for the rest of your trading life. Toss away your again Gann Fans, Fibonacci Angles, and Andrew Pitchforks. This is the real deal.

There’s another thing I would like to get off my chest…

Just like you I see a lot of systems and seminar offers, but for the most part, what I see is a regurgitation of things like Fibonacci, moving averages, candlesticks, cycles and the like… all of that is passé.

Much of it doesn’t work and can’t be proven. That’s not what I’m offering here. I’m offering techniques I personally use. You don’t need to have a leap of faith to make my material work. It’s been tested and traded in real-time, because I really trade… I really use this. I don’t trade just one or two lot trades. Do the other so called ‘hot shots’ do this? I don’t think so!

These are techniques I developed – no one else did. They’re not in-print, and not available any other place. They are the unique product of my trading experience and research… this means it will be a treat for the serious student of the marketplace. If that’s you, you’re going to love this material.

If that’s not you, if you’re the type of person who wants to get buy and sell signals from an advisory service… then this course is not for you. Save your money. I am only interested in students of the marketplace. People looking for a fast food approach to trading turn me off. God bless you. I hope you’re trading goes well, but I want people who are hungry to know how to do this, not just hungry for a trade.

I just had my 72nd birthday… I’m not interested in finding another trade for someone. I am interested and thoroughly excited about showing you what I know, teaching you what I have learned, and saving you the aggravation, pain, and agony I have had to go through. I wish I would’ve met me 50 years ago!

SPECIAL PRICE FOR LWU STUDENTS

This online trading course is available at a reduced price for my LWU students who have completed Swing Trading Futures & Commodities Level 2 course. That is an expensive course, and I appreciate your patronage. Because you have been a prior customer, the cost of the seminar has been substantially reduced. Please email customer service for your special price: [email protected]

As you know these days most commodity, stock, and futures seminars or online courses sell for $7,000 – $10,000. I’ve seen several now priced at over $20,000. The Trend Trading Stocks, Futures & Commodities comes with a very low price tag. I think you should be able to get back — on your first couple trades — the course expense using what you will learn. The price is just $3,995.

I suggest you order today, not only to save money but to make certain you get the best in cutting edge Larry Williams’ technology and trading tools.

To order, you can simply click below. And we can get you instantly set up online.

In just a few minutes from now you can start reading the Trend Trading Stocks, Futures & Commodities course manual, watching the course videos, and see Larry’s tools in action in his Trend Trading webinar archive.

Delivery Method

– After your purchase, you’ll see a View your orders link which goes to the Downloads page. Here, you can download all the files associated with your order.

– Downloads are available once your payment is confirmed, we’ll also send you a download notification email separate from any transaction notification emails you receive from imcourse.net.

– Since it is a digital copy, our suggestion is to download and save it to your hard drive. In case the link is broken for any reason, please contact us and we will resend the new download link.

– If you cannot find the download link, please don’t worry about that. We will update and notify you as soon as possible at 8:00 AM – 8:00 PM (UTC+8).

Thank You For Shopping With Us!

![[Download Now] Rob Pene - Get More Clients Video Analysis for Leads From Cold Email](https://kickmarketers.com/wp-content/uploads/2024/01/download-now-rob-pene-get-more-clients-video-analysis-for-leads-from-cold-250x297.png)

Nicholas (verified owner) –

The course materials were top-notch. Excellent quality!

Michael Smith (verified owner) –

The course materials were top-notch. Excellent quality!

Rebecca Bryant (verified owner) –

The course was engaging and easy to follow.

Richard (verified owner) –

The course was well-paced and easy to follow.

Kevin (verified owner) –

The instructor’s passion for the subject is contagious.

David (verified owner) –

The course was engaging and easy to follow.